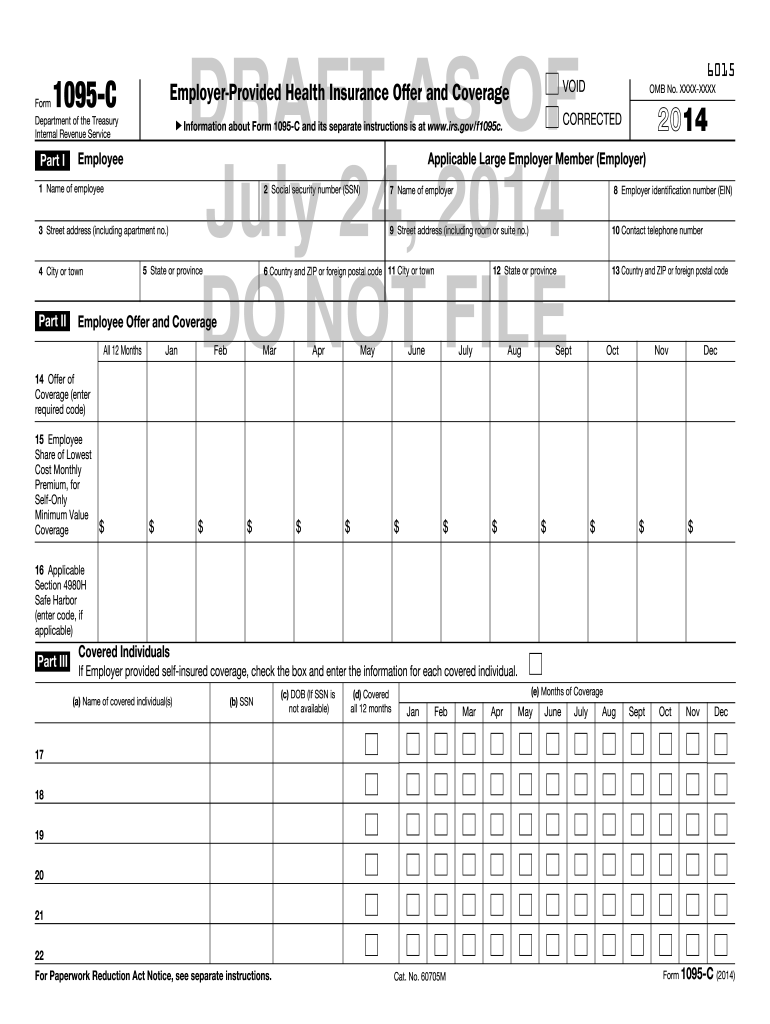

Nov 11, · For tax year , Form 1095C gets updated with brandnew offer codes employers can enter in line 14 You'll use it to indicate the type ofJun 07, 19 · Edited If you have a 1095C, a form titled EmployerProvided Health Insurance Offer and Coverage the IRS does NOT need any details from this form You can keep any 1095C forms you get from your employer for your records When you come to the question "Did you have health insurance coverage in 15", simply select "Yes"Mar 31, · 1095C that they file with the IRS Further, the information reported on Parts I and III of Form 1095C will inform OTR whether the employer was fully insured and will identify employees who were provided minimal essential coverage by an applicable entity that may not be required to file Forms 1094B and 1095B with OTR 11

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

1095 c form meaning 2020

1095 c form meaning 2020-Form 1095B An IRS Form sent to individuals who received minimum essential coverage as defined by the Affordable Care Act1218 Form 1094C () Page 2 Part III ALE Member Information—Monthly (a) Minimum Essential Coverage Offer Indicator Yes No (b) Section 4980H FullTime

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

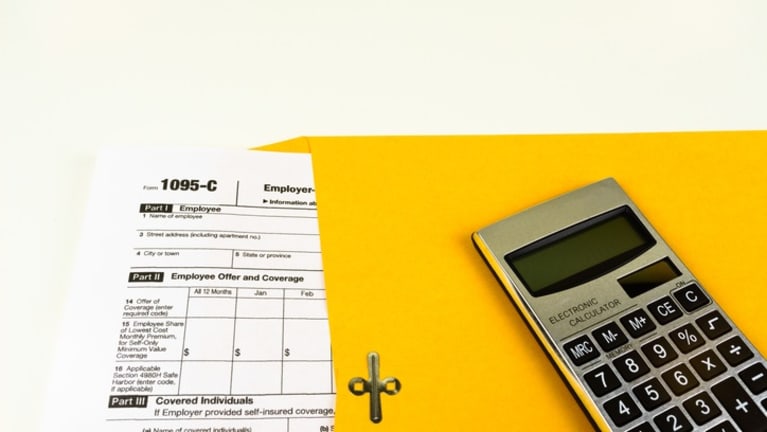

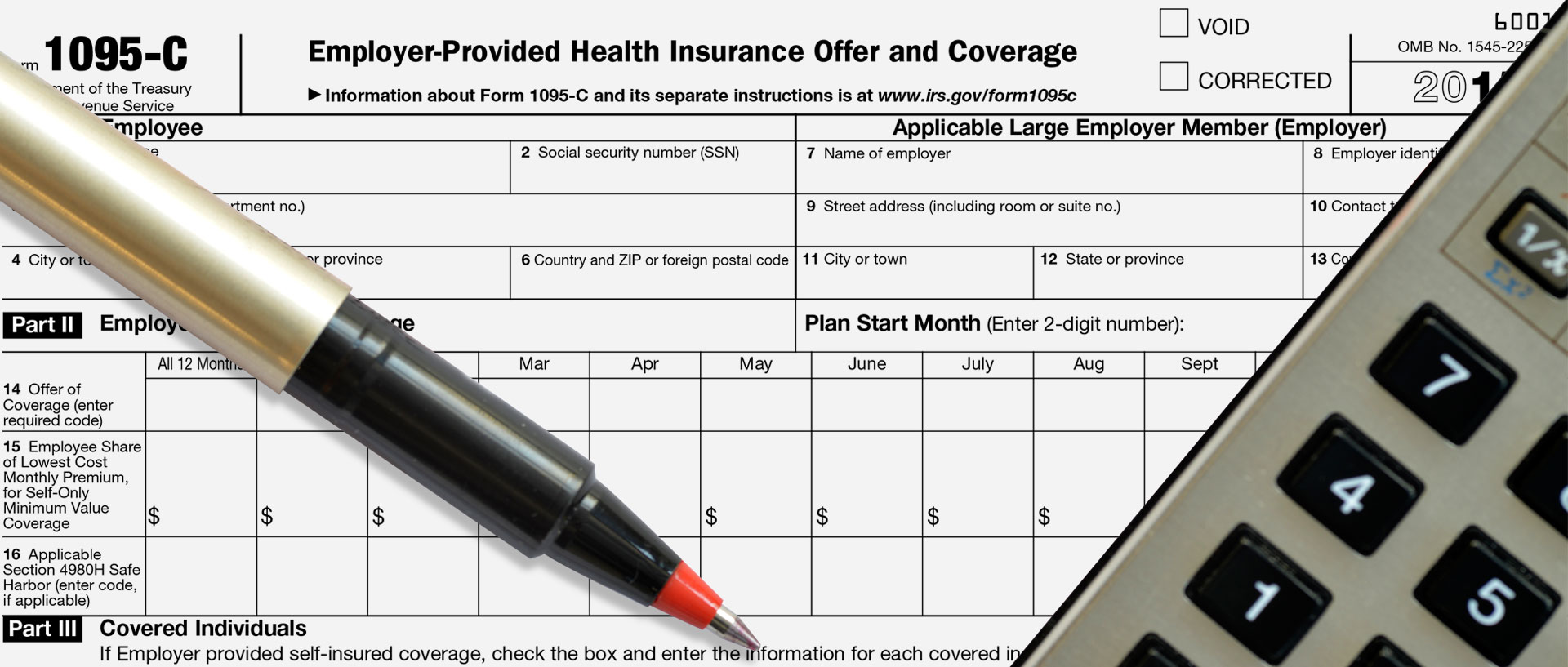

Content updated on February 11, To manage the risk of Affordable Care Act penalties, employers can use one of three affordability safe harbors for reporting on Line 16 of IRS Form 1095CForm 1095C Form 1095C, employerprovided health insurance offer and coverage, shows the coverage that is offered to you by your employer It is used by larger companies with 50 or more fulltime or fulltime equivalent employees This form provides information of the coverage your employer offered and whether or not you chose to participateForm 1095C New ICHRA codes to enter on Line 14 From the tax year , employers need to report the Individual coverage health reimbursement arrangement (ICHRA) offered to employees and their dependents In addition to the existing codes, below are the new codes for line 14

CODES FOR IRS FORM 1095C 2F Section 4980H affordability Form W2 safe harbor Enter code 2F if the employer used the section 4980H Form W2 safe harbor to determine affordability for purposes of section 4980H(b) for this employee for the year If an ALE Member uses thisForm 1095 is a collection of Internal Revenue Service (IRS) tax forms in the United States which are used to determine whether an individual is required to pay the individual shared responsibility provisionIndividuals can also use the health insurance information contained in the form/forms to help them fill out their tax returns The individual forms are Form 1095A "A Health InsuranceThere is no longer a federal mandate to have health insurance and you do not have to file Form 1095C on your Tax return Prepare and eFile Your Taxes here on eFilecom 1095C If you and/or your family receive health insurance through an employer, the employer will provide Form 1095C by early March 21

Mar 02, 21 · How the Supreme Court Could Rule on the Affordable Care Act, SHRM Online, September IRS Issues Draft Form 1095C for ACA Reporting in 21, SHRM Online, JulyWhat's on Form 1095A and why you need it Your 1095A contains information about Marketplace plans any member of your household had in , including Premiums paid;Employers are required to furnish Form 1095C only to the employee As the recipient of this Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their records

Benefits 1095 C

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

Oct , · Form 1095C is the IRS form employers provide to their employees detailing employerbased health coverage they received during that calendar year Every applicable large employer (ALE) needs to furnish a Form 1095C to each employee with information about their medical benefits for reporting purposesNov 02, · The IRS recently released final Forms 1094C and 1095C and Instructions for Forms 1094C and 1095C (Instructions) The IRS also released final Forms 1094B and 1095B and related instructions The forms largely mirror the 19 versions, but they include a few substantive changesForm 1095C EmployerProvided Health Insurance Offer and Coverage is a tax form reporting information about an employee's health coverage offered by

Fillable 1095c Fill Online Printable Fillable Blank Pdffiller

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

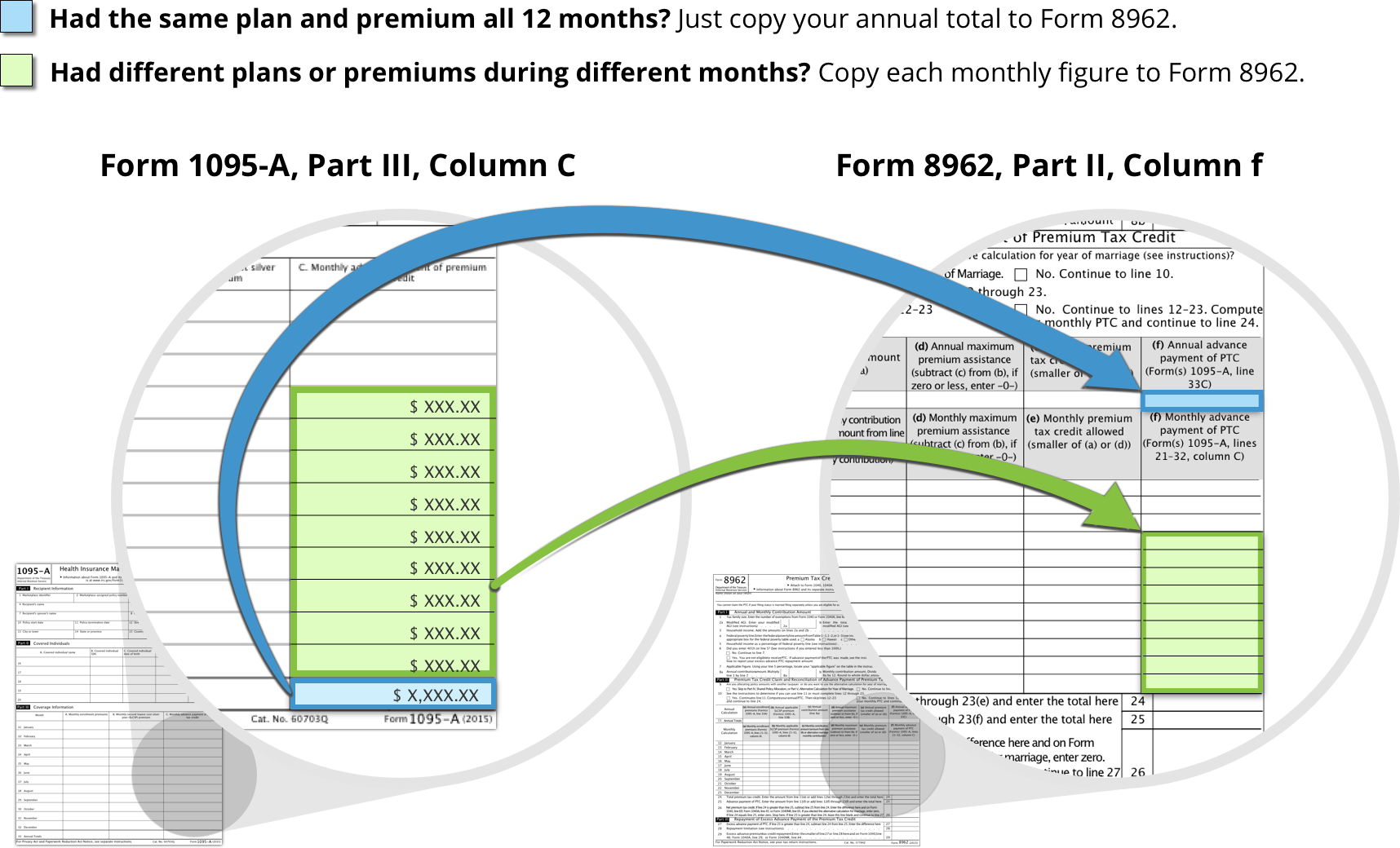

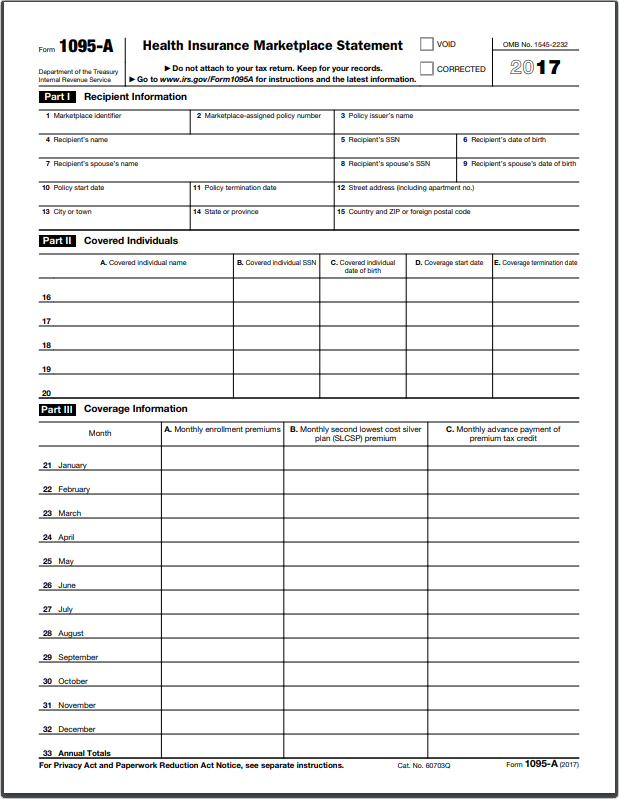

Form 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverage Use the information contained in the 1095C to assist you in determining in you are eligible for the premium tax creditDetermining a company's ALE status is at the center of many employers' struggles to understand if IRS rules for Affordable Care Act reporting apply to themIf you bought your plan there, you should get a Form 1095A, also called the "Health Insurance Marketplace Statement" The IRS also gets a copy of the form The form provides information about your insurance policy, your premiums (the cost you pay for insurance), any advance payment of premium tax credit and the people in your household covered

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

Aca Code Cheatsheet

Feb 07, 19 · Form 1095C is sent to those who worked fulltime in 18 for what the IRS calls "an applicable larger employer" That means an employer with 50 or more fulltime employeesOn July 13, , the IRS released a Form 1095C draft, which adds new 1095C codes from 1L to 1S for employers to indicate the method used to determine their ICHRA plan's affordability Click here to learn more about ICHRA The codes are mentioned hereForm 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn more

Irs Extends Deadline To Provide Forms 1095 C To Employees

How To Reconcile Your Premium Tax Credit Healthcare Gov

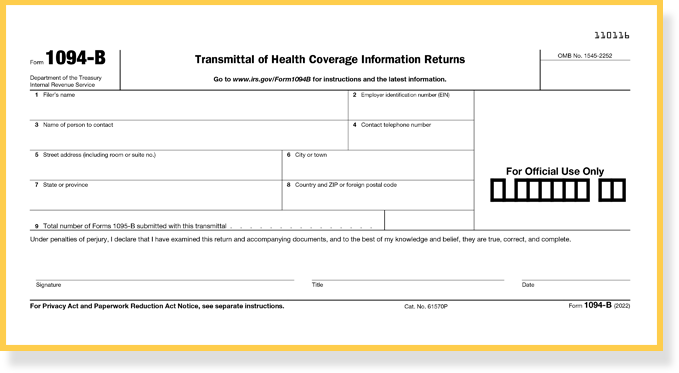

This is required for the Form 1095C The Applicable Large Employer (ALE) must enter a twodigit number Form 1095C, Parts I, II, and III, for any employee who enrolls in (meaning that for all 12 calendar months the employee was not a fulltime employee), for Form 1095C, Part II, the ALE Member must enter code 1G onForm 1095C EmployerProvided Health Insurance Offer and Coverage 19 Form 1095C EmployerProvided Health Insurance Offer and Coverage 18 Form 1095C EmployerProvided Health Insurance Offer and Coverage 17 Form 1095C EmployerProvided Health Insurance Offer and CoverageA single Form 1094C must accompany the set of Forms 1095C when filing to the IRS Large employer reporting penalties Employers that do not submit an annual IRS return or provide individual statements to all fulltime employees may be subject to a penalty Waivers are available when failure to report is due to a reasonable cause

Form 1095 C Adding Another Level Of Complexity To Employee Education And Communication The Staffing Stream

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

You claim it by filing Form 62 with your tax return You'll need your Form 1095A to fill out this form Form 1095C, Health Coverage, is used to report the type of health coverage you had, dependents covered by your insurance, and how many months you had coverage for in 19 to the IRSOct 15, · Extended Deadline to Furnish Forms 1095C to Employees IRS Notice 76 announced an extension of the deadline to furnish Forms 1095C to employees until March 2, 21, but employers are encouraged to furnish such statements as soon as possible The extension is automatic and does not need to be requestedMar 23, 21 · The Form 1095B is an Internal Revenue Service (IRS) document that many, but not all, people who have MediCal will receive The Department of Health Care Services (DHCS) only sends Form 1095B to people who had MediCal benefits that met certain requirements, known as "minimum essential coverage (MEC)," at least one month during the tax year

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement Templateroller

The Abc S Of Forms 1095a 1095b And 1095c Aca Gps

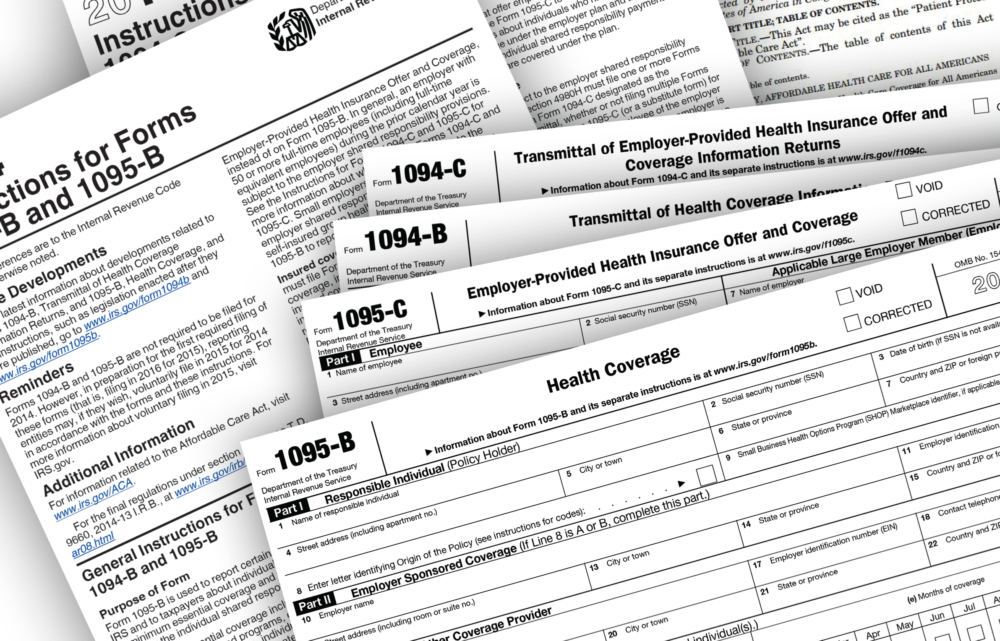

Inst 1094C and 1095C Instructions for Forms 1094C and 1095C Form 1095A Health Insurance Marketplace Statement Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement Form 1095BForm 1095C is used by qualifying employers with 50 or more fulltime employees (including fulltime equivalents) that are subject to the employer responsibility provisions of the ACA Form 1095C contains information about the offer of health insurance coverage to employees and theirJan 18, 15 · The 1095 forms are filed by the marketplace (1095A), other insurers (1095B), or by your employer (1095C) We have simple instructions for the 1095 forms Keep in mind the 1095 forms are filed by whomever provided you coverage,

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

New 1095 C Codes Will Apply To The Tax Year Aca The New 1095 C Codes For Explained

Extension of due date for furnishing statements The due date for furnishing Form 1095C to individuals is extended from January 31, 21, to March 2, 21 See Notice 76 and Extensions of time to furnish statements to recipients Relief for failure to furnish statements to certain employees enrolled in selfinsured health planOct 29, · The ALE furnishes the Form 1095B within 30 days of receiving the request This furnishing relief also extends to Form 1095C for employees enrolled in an ALE's selfinsured health plan who are not fulltime employees for any month in Extension of good faith relief for reporting and furnishing – The IRS will not impose a penalty forFeb 25, 21 · As filing deadlines for the tax year approach, it is critical that your organization have an understanding of the new and old codes On Line 14 of Form 1095C, employers are prompted to enter a code that describes the type of health coverage offered to a particular employee during the tax year

The New 1095 C Codes For Explained

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

SUBJECT FORM 1095C INFORMATION The following information is prepared to help employees better understand their 1095C forms A What is the Form 1095C that I am receiving?Mar 02, 21 · Form 1095C is an annual statement that employers must provide fulltime employees and those covered by its health insurance plan You can get yours Mailed to your home Please be sure your current mailing address is in Self ServiceJan 31, · This form is to reconcile your Premium Tax Credit;

Annual Health Care Coverage Statements

Your 1095 C Obligations Explained

Premium tax credits used;Sending out 1095C forms became mandatory starting with the 15 tax year Employers send the forms not only to their eligible employees but also to the IRS Employees are supposed to receive them by the end of January—so forms for would be sent in January 21Form 1095C is a tax form under the Affordable Care Act ("ACA") which contains information about your healthcare insurance coverage

Form 1095 C The Aca Times

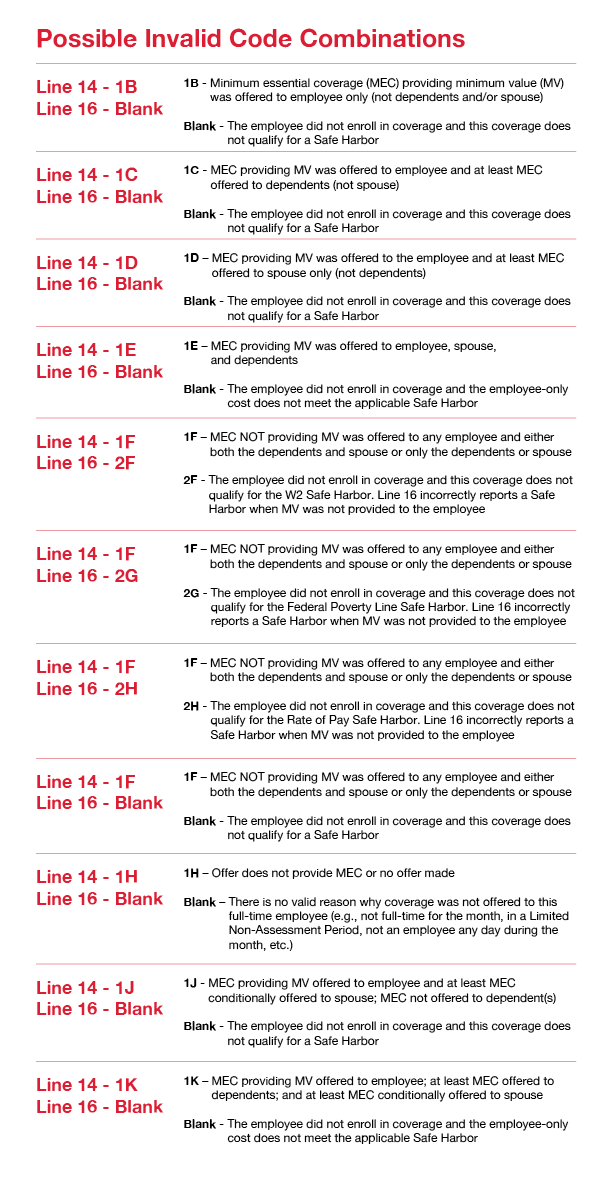

Eleven Irs Form 1095 C Code Combinations That Could Mean Potential Penalties

Feb 24, · The Codes on Form 1095C Explained February 24, Robert Sheen Affordable Care Act 3 minute read Every year Applicable Large Employers ("ALEs") must file Forms 1094C and 1095C with the IRS and furnish Forms 1095C to employees considered fulltime under the Affordable Care Act ("ACA")Form 1095 Code Definitions Lines 14, 15, and 16 Line 14 Offer of coverage code 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for selfonly coverage equal to or less than 95% mainlandA figure called "second lowest cost Silver plan" (SLCSP) You'll use information from your 1095A to fill out Form 62, Premium Tax Credit (PDF

Your 1095 C Obligations Explained

What Is Form 1095 C And Why Did I Receive It In The Mail From The Irs

Oct 29, · An ALE should furnish an ACA Form 1095C to each of its fulltime employees by March 2, 21, for the calendar year An ALE should file ACA Forms 1094C and 1095C by March 31, 21, if you choose to file electronically, and the Form should file by February 28, 21, if filing on paper Click here to know the State filing deadlinesIf there is only one 1094C being filed for an employer's 1095C forms, that form is identified on Line 19 as the Authoritative Transmittal If multiple 1094C Forms are required to file an employer group's 1095C Forms, one of the Forms 1094C must assume Authoritative Transmittal in Line 19 and report aggregate employerlevel dataDec 09, · A responsible official authorized to file the 1095C's on behalf of the company must complete the registration process As with federal 1095C reporting, California requires a test file be submitted We will have more details on the process of submitting a test file in a future blog post Form 1095B

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Changes Coming For 1095 C Form Tango Health Tango Health

Oct 19, · On October 15, the IRS finally released its draft instructions for the Forms 1094C and 1095C While we knew substantial changes were coming to the instructions as a result of Individual Coverage HRAs (ICHRAs), the IRS also made changes that will impact every employer required to file the Forms As a result of most employers not offering ICHRAs and for simplicity

Irs Form 1095 C Codes Explained Integrity Data

Accurate 1095 C Forms Reporting A Primer Integrity Data

What Is Form 1095 C Employer Provided Health Insurance Offer And Coverage Turbotax Tax Tips Videos

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 62 Premium Tax Credit Definition

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

1095 C Faqs Mass Gov

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Understanding Irs Forms 1095 A 1095 B And 1095 C

Guide To Form 1095 H R Block

Benefits 1095 C

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Need To Correct An Irs 1094 C Or 1095 C Form

Form 1095 C Released New Codes New Deadlines

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Aca Code Cheatsheet

Aca Code Cheatsheet

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Form 1095 C Guide For Employees Contact Us

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

The Affordable Care Act S Employer Mandate Part 4 Blog Mma

Accurate 1095 C Forms Reporting A Primer Integrity Data

Covered California Ftb 35 And 1095a Statements

Irs Issues Draft Form 1095 C For Aca Reporting In 21

What Is Form 1095 C Acawise Youtube

Sample 1095 C Forms Aca Track Support

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

Irs Final Aca Compliance Forms Now Available Bernieportal

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

Irs Form 1095 C Fauquier County Va

Updates To Form 1095 C For Filing In 21 Youtube

1095 C Form Official Irs Version Discount Tax Forms

Irs New Deadline For Aca Reporting Documents Bernieportal

Eleven Irs Form 1095 C Code Combinations That Could Mean Potential Penalties

Where Do I Find My 1095 Tax Form Healthinsurance Org

What S New For Tax Year Aca Reporting Air

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

What Are The Differences Between Form 1095 A 1095 B And 1095 C

What The Heck Is Form 1095 C

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Compliance Considerations Covid And 1095 C Reporting Hays Companies

Avoid Common Errors This Aca Reporting Season Health E Fx

10 Questions Employees Are Asking In 19 About Aca 1095s Word On Benefits

Changes Coming For 1095 C Form Tango Health Tango Health

1095 A Tax Credits Subsidies For Form 62 Attaches To 1040 Covered Ca

Know The Basics Form 1095 C Justworks

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Aca Reporting Faq

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

The Aca S 1095 C Codes For The Tax Year What Employers Need To Know About The Aca 1095 C Codes

Aca Reporting For Just Got More Complicated Syncstream Solutions

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

Yes Employers Still Need To File Forms 1094 And 1095 Word On Benefits

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Irs Extends Aca Reporting Deadline For Furnishing Statements For From February 1 To March 2 21 Innovative Benefits Planning

Form 1095 A 1095 B 1095 C And Instructions

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

7 Questions Employees Are Asking In About Aca 1095s Word On Benefits

0 件のコメント:

コメントを投稿